Personal Security on the Web

Personal Security and Banking on the Web

Todd Wolinsky

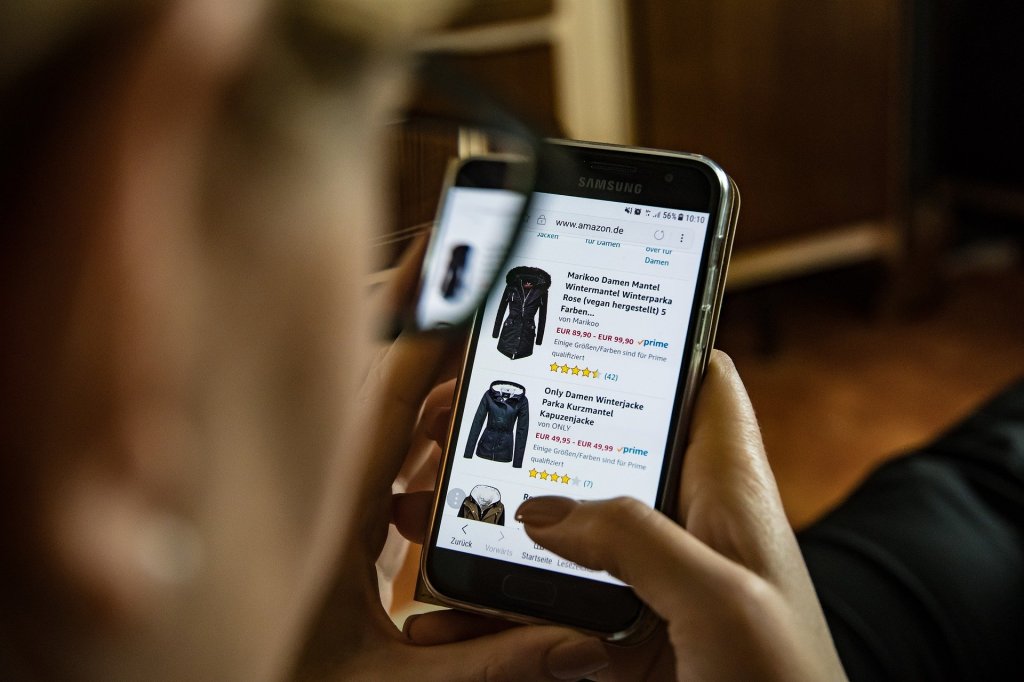

Rapper Notorious B.I.G. once famously lyricized “mo money, mo problems.” With the advent and explosion of online banking platforms and peer to peer payment apps, like Venmo and PayPal, maybe he struck a bigger chord than he first realized. Fraudsters, hackers, and cybercriminals, today’s modern-day bank robbers, have targeted this growing industry with great intensity. These modern-day Bonnie and Clydes have plenty of opportunities. A recent FIS Global Consumer Banking report noted that 72% of banking interactions occurred online. Because of this greater convenience, many would struggle to remember the last time they wrote a check or visited a bank lobby to make a transaction. With this trend likely to continue, the financial world and consumers should take note and use extra precautions to protect one’s personal security on the web.

“Mo money, Mo problems…”

-The Notorious B.I.G.

With increased use, comes increased risk. According to Security Intelligence, a cyber security think-tank, there are a few key areas that should be of concern for one’s personal security when using online banking. These platforms have access to personal banking information and malware attacks are a major threat. Malware attacks on banking systems, or on a user’s device, can harm the functionality of an app or site and possibly steal personal information through a spyware attempt. Another consideration that the banking industry is concerned about, is poor app or site design. These could easily be hacked. Passwords, account information, and obviously one’s hard earned cash could easily be jeopardized by an app or online banking system that was poorly constructed. One more major concern of the Security Intelligence think-tank is the prevalence of un-secured WIFI locations where customers use online banking. Many stores, libraries, and schools allow easy access to WIFI. This easy access makes it possible for fraudsters to lure unsuspecting users to a similarly named, but maliciously designed WIFI network. For example, on campus one can log-on to the “bloomu” network, but a cybercriminal may set up a network named “bloomu1,” so that the unsuspecting victim logs on, and uses their banking app. When this happens, their personal information could be accessed, and their personal security is breached.

Financial institutions, including Paypal and Venmo, are continuously taking steps to keep their platforms secure. This includes high level encryption programs and large liability insurance programs to protect customers. In order to maintain their customer’s trust, it is in their businesses’ best interest to do so. There are also steps users can take to protect their personal information when using online banking options. First, using various passwords for different banking applications and changing them from time to time. This will make it harder for hackers to access multiple accounts of the same user. If necessary, use a password manager app to keep track of all passwords. Next, ensure phones, computers, and apps are up to date with the latest software updates. This will guarantee that the user has the latest security firewalls. Users should also beware of emails that look like they are from their banking institutions asking for account information. Banks will never send an email asking for this information. This is most likely a phishing scheme to steal the information.

The personal security of one’s banking information when using online system will continue to be an area of concern and focus for many. Hopefully some of this information will prevent ‘mo problems’ when one has ‘mo money.’

Additional Information Concerning Secure Online Banking

- General tips about online banking from Nerdwallet.com

- Tips for using Paypal from Creditcards.com

- Tips for using Venmo from Investopedia.com

Works Cited

Abrams, S. (2018, October 22). How to Keep Your Information Safe When Online Banking. Retrieved February 6, 2020, from https://money.usnews.com/banking/articles/how-to-keep-your-information-safe-when-online-banking

Burnette, M., Burnette, M., Margarette, & USA Today. (2018, February 13). Is Online Banking Safe? How to Boost Your Banking Security. Retrieved February 8, 2020, from https://www.nerdwallet.com/blog/banking/online-banking-security/

Charles, B. S. (2017, August 7). Is Mobile Banking Safe? Retrieved February 6, 2020, from https://securityintelligence.com/is-mobile-banking-safe/

Eckstein, J. (2020, January 29). How Safe Is Venmo and Is it Free? Retrieved February 8, 2020, from https://www.investopedia.com/articles/personal-finance/032415/how-safe-venmo-and-why-it-free.asp

The Notorious B.I.G. (Ft. Diddy & Ma$e) – Mo’ Money Mo’ Problems. (1997, March 25). Retrieved February 6, 2020, from https://genius.com/The-notorious-big-mo-money-mo-problems-lyrics

Zetlin, M. (2019, August 5). Is PayPal Safe? 10 security tips to protect yourself. Retrieved February 8, 2020, from https://www.creditcards.com/credit-card-news/paypal-safety-tips-1280.php

Follow My Blog

Get new content delivered directly to your inbox.

Todd, This is a great article. I didn’t realize that a poorly constructed app could wreak such havoc. I always placed blame on the hacker and not the hackee. Thank you for the enlightenment!

LikeLike